US Sales Tax

Sales Tax in US is the tax implemented on lease or sales of product or service. At the time of the sale, seller collects the sales tax. By multiplying purchase price of a product with the applicable tax rate, sales tax is calculated. Unlike the GST or value added tax a sales tax is implemented only at the retail level. The sales taxes implemented by the states are either levied the tax on retail sellers or on the retail buyers and require collecting it by the sellers.

Sales Tax Rules

There are three main factors on which sale tax depends including

1. Your nexus that signifies the state to which you have connection with are the only state you are accountable to pay tax.

2. The services or products in your product inventory, which implies that different tax rates applies to different products

3. When you are not liable for tax, this may vary from product to product and state to state.

Nexus and Registration

The initial step is to find out which states and agencies, you are accountable to pay taxes, which depend on the states you have a connection to and what type of connection is it, whether it is a physical or non-physical connection. The physical connection is like a stockroom that is used for storing goods or non-physical connection is like a contact that contributes to your sales.

The connection of company and the state is Nexus connection. Nexus is the significant to determine if your company is accountable to pay the sale tax in a state. If you do not have the nexus in the state, you are not liable to pay tax in that states.

In each state where your company has nexus, you will have to register to pay tax, which includes registering in state where your company is located, states where you are having fulfillment services, all the states, where you visited for business frequently, affiliate marketing programs and remote employees. All the states need businesses that are selling the taxable products in their state to have to register at least 1-2 weeks before the selling, On registration your business will get a sales tax license officially.

Sales Tax Rates

To calculate the exact tax that you have to apply on your invoices means accounting for:

- The tax applied to the goods in your product catalog: various types of products are differently taxed in the US (such as, food products are excluded from tax in California).

- The tax layers that are applied to a specific address: county, state, city local and special district taxes (such as, Minnesota’s sale tax rate is 6.875% but can go high as 8.375% depending on municipal and local taxes). You should use the complete address of your customer to keep you notified of what tax you are accountable to collect from them - each of the tax jurisdictions is classified by various criteria and can differ from one address to the next. It is normal to have the multiple sales tax rates in a single ZIP code

Exemptions

It is better to check with your state government on which services and goods sales tax are implemented. Below given transactions are taxes exempt usually:

- Resold items – Resellers and retailers don't have to pay the sales tax on wholesale purchases typically as it is supposed that the sales tax paid by the end consumer on these products at the time of purchase.

- Raw materials – In case you make and sell products that will become the raw material for other products, such items are considered as sales tax exempt typically.

- Non-profits – In some cases, sales made to the non-profits are excluded from sales tax. In case you are selling to a non-profit, ensure that you take a copy of their tax exemption certification that will be issued by the state.

State-specific exemptions - Various states provide limited phase where purchases are made tax-free, so it is mandatory to keep an eye open for them such as, Texas provides an exemption on the sales tax in August throughout the period of leading up to the starting of the New Year. These are mentioned as "sales tax holidays" usually.

Invoices

Setup invoice settings to ensemble any specific tax needs you may have at the Invoice Customization page.

Configuring USA Sale Tax in ChargeMonk

Go through all the steps given below to configure Sale Tax in ChargeMonk

Step-1-Update-the-address-of-your-organization

Ensure that you have added the address of your organization at Settings > Configure ChargeMonk > Business Profile. You will not be able to setuup taxes in ChargeMonk if you don’t complete this step in initially.

Step 2: Enable Tax

Follow Settings > Configure ChargeMonk > Taxes and hit Enable Tax.

Step 3: Choose a Price Type for USD

Enable the taxes once and you will be forwarded to a page comprising all the currencies that you have enabled for your site. Step 3 is setting up a price type, which signifies the price that is quoted by you for your service/add-on/product and can be either tax inclusive, or tax exclusive for each of these currencies. Sales Tax regulation in the US calls for the product price to be tax exclusive. Selecting a price type which is tax exclusive here will make sure that Sales Tax displays as extra to the final price in the invoices always.

Note

In case you are selling your product to the US in some other currency, visit how to configure price type for a region so that your invoices will be aligned to the regulations here.

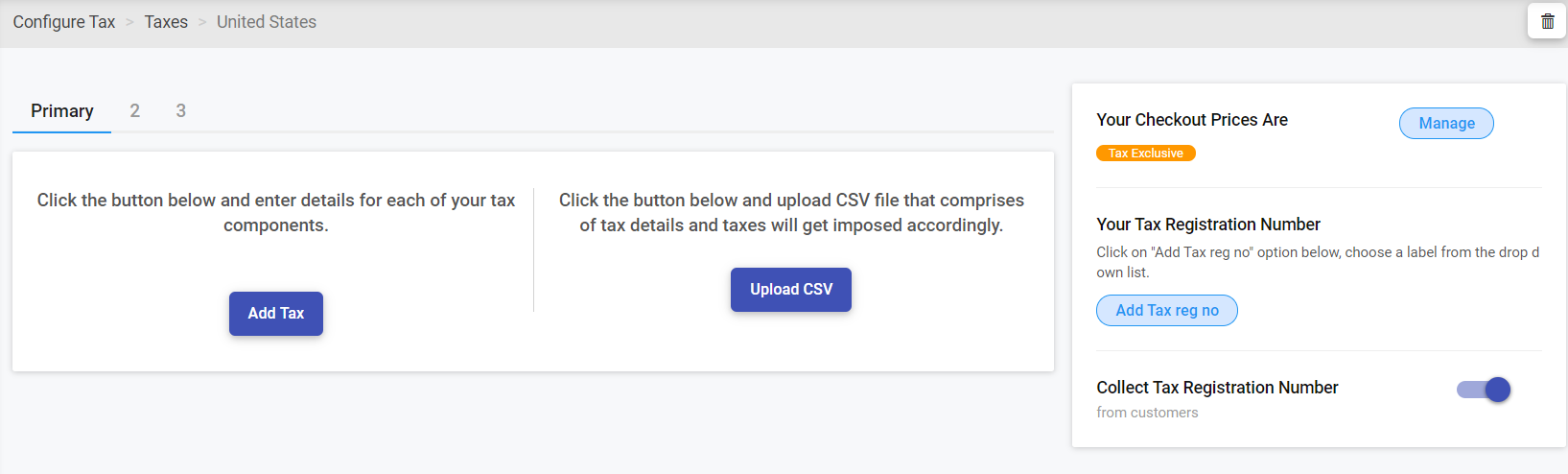

Step 4: Hit Add Region and select US

Hit on Add Region and choose ‘US' from the list of region.

You will be forwarded to the US Sale Tax configuration page now.

Step 5: Add your tax registration number

Type your tax registration number and label here.

Step 6: Add your tax prices

Now, enter your tax prices to ChargeMonk so it can apply the relevant amounts automatically to invoices. It can be done with three options given below:

- Via CSV

- Via Avalara – this is a third party application, which automates what tax rates are implemented to a particular invoice or,

- By adding the tax prices into the configuration page manually.

Option A: Upload a CSV

Add your tax prices to ChargeMonk by submitting a CSV file with the tax information you want ChargeMonk to know about.

On the basis of your tax requirements, you have to offer some or all of the following information in the CSV file:

- Country code (2-letter ISO 3166 alpha-2 country code)

- State code (ISO 3166-2 state code)

- ZIP code

- Tax name (State tax, County tax etc.) and tax rate

- Jurisdiction type: for example federal or locale, name: name of the jurisdiction, and also the code allocated to the name of jurisdiction. These details allow you to classify your taxes easily as per the jurisdiction, for the reporting purposes.

In case you want to setup over one tax price in ChargeMonk, you have to repeat these details in the CSV file, for each of the tax price. You can also use such option to set up to four dissimilar tax prices.

How will ChargeMonk calculate what tax rate to impose?

To calculate which tax rate is levied to a specific invoice ChargeMonk matches the address details of the customer with the details you have configured in your CSV file.

Steps to match location details:

- In case the subscription shipping address of customer is available, it will be helpful to find a match in your CSV file. Once a match is found, ChargeMonk will implement the consequent tax rate to that invoice.

- In case there is no shipping address available, ChargeMonk will try to match the billing address of customer with the CSV file. Once it is matched, ChargeMonk will implement the consequent tax rate.

- In case both billing address and shipping address details do not match the details in the CSV file, tax will not be imposed.

Using ZIP code to apply a tax rate:

ChargeMonk uses the zip code to determine the exact tax rate to implement to a consumer. You will be able to add five digit and ZIP+4 zip codes in CSV file. Whenever a customer adds their zip code during the checkout, ChargeMonk will try to match the entry to a zip code in your CSV to find out what tax rate to impose to their invoices.

In case your CSV comprises five-digit zip codes, ChargeMonk will find a match by imposing a tax rate once matched in the following priority order:

- Direct match: ChargeMonk will try to match all the five digits in the zip code.

- Prefix match: In case a direct match doesn’t succeed, ChargeMonk will try to match the zip code’s first three digits.

- Range match: In case the earlier two tries to match the zip code fail, ChargeMonk will try to match the zip code to a specific range, which signifies that; if the zip code added is 12345, ChargeMonk will try to match it with the range within 12340 and 12350, and implement the corresponding tax rate).

- In the CSV, you are able to specify a tax rate for ChargeMonk to use, in case all the above matches fail, mark such tax rate with an asterisk (*).

In case your CSV comprise ZIP+4 codes, ChargeMonk will use a similar matching process, in the below given priority order:

- Direct Match: ChargeMonk will try to match all the nine digits in the zip code.

- Range Match: In case a direct match falls short, ChargeMonk will try to match zip code’s first five digits to a specific range. For example: if the zip code added is 12345-6789, ChargeMonk will attempt to match it within the range 12345 and 12346, and impose the consequent tax rate.

- In case both fail, ChargeMonk will try to match only the first five digits.

Option B: Use Avalara

A cloud-based SaaS solution, which is used for taxation and compliance requirements is known as Avalara.

With ChargeMonk's Avalara association, you can manage taxation easily by eliminating the requirement to setup tax for each nexus or taxable region manually. As per the jurisdiction rules, Avalara mechanize exact address validation, rate determination, reporting, and tax filing.

Avalara manages tax rate updates also, so that you won't have to update the tax rates manually, whenever they change. You have to do is to associate your Avalara account with ChargeMonk manually and take care of some prerequisites given below.

See also

How to configure your ChargeMonk-Avalara association?

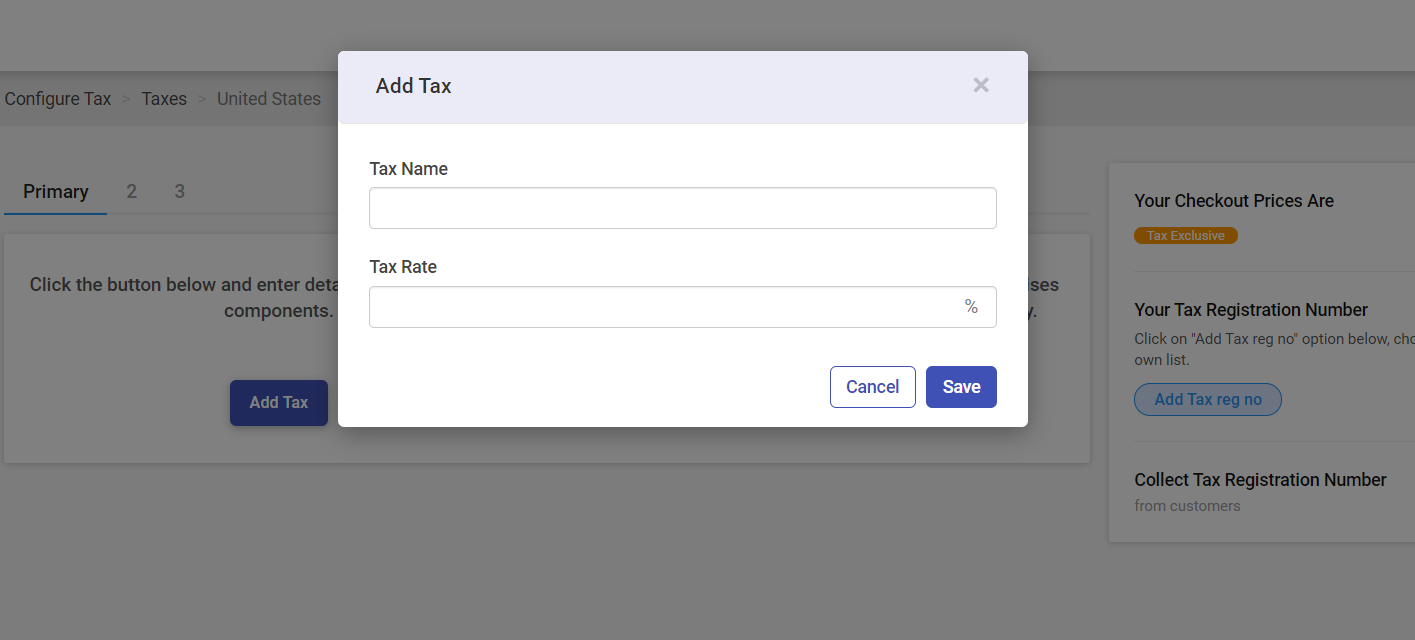

Option C: Add your tax rates manually

You have to enter a tax rate and the tax label for each tax that you want ChargeMonk to implement to your invoices.